Introduction

In 2025, Southeast Asia trade opportunities will have become impossible for American businesses to ignore. With a $3.7 trillion economy and over 677 million consumers, the region is fast becoming the new frontier for global investment. For U.S. companies looking to diversify supply chains, reduce dependency on China, or explore fresh consumer markets, Southeast Asia trade opportunities offer both strategic advantages and long-term growth potential.

From Vietnam’s booming manufacturing sector to Singapore’s fintech leadership, Southeast Asia trade opportunities span every major industry. This guide breaks down key markets, trade agreements, and investment incentives so that American firms can make informed, profitable decisions. Whether you’re a startup or a multinational, understanding Southeast Asia trade opportunities is no longer optional—it’s essential for global relevance..

Key Takeaways:

● Southeast Asia’s $3.7 trillion economy grows 3x faster than the U.S.

● 99% tariff elimination creates seamless trade opportunities

● American companies are shifting supply chains from China to Southeast Asia

● 677 million consumers represent a massive market potential for U.S. businesses

Table of Contents:

- Southeast Asia Business Opportunities

- Investment Market Entry Strategies

- ASEAN Free Trade Benefits

- Supply Chain Diversification

- Country-Specific Investment Guide

- Frequently Asked Questions

Southeast Asia Business Opportunities: Why This Region

Matters for American Companies

Located at the crossroads of major shipping lanes between the Indian and Pacific Oceans, Southeast Asia isn’t just geographically strategic—it’s economically essential. The region includes Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, Timor-Leste, and Vietnam, collectively home to 677 million people, generating over $3.7 trillion in economic output annually. To put that in perspective, Southeast Asia’s economy is larger than Germany’s and growing three times faster than the U.S. average. For American businesses looking to diversify supply chains away from China, Southeast Asia offers the perfect alternative: competitive costs, improving infrastructure, and governments eager to partner with American companies.

Investment Opportunities in Southeast Asia: Market Entry

Strategies for U.S. Businesses: Investment Opportunities in Southeast Asia

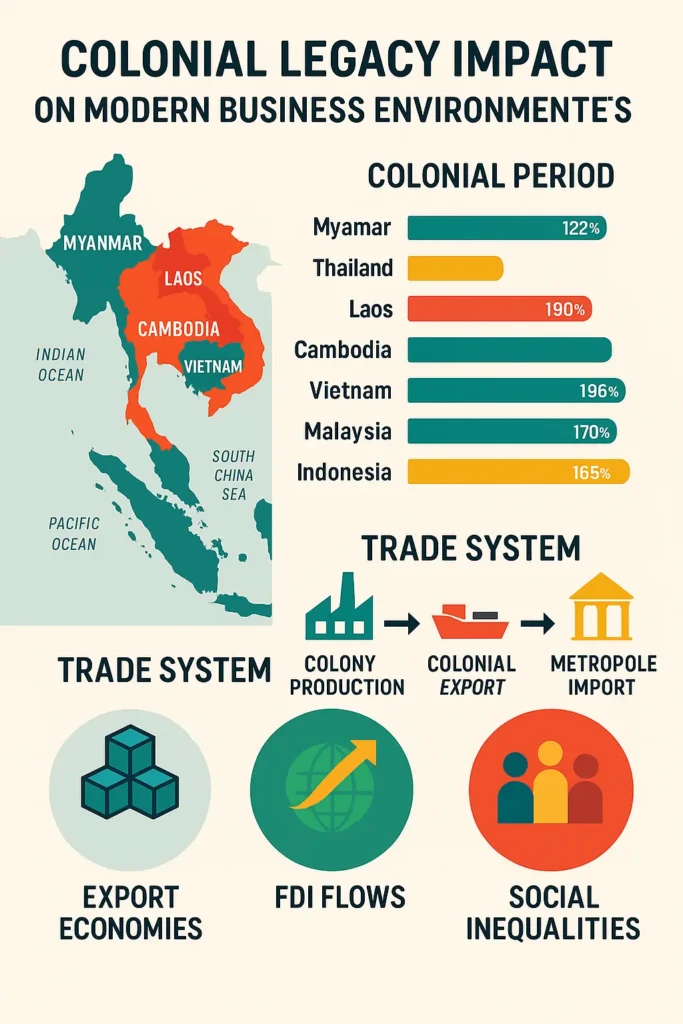

Understanding Southeast Asia’s colonial past helps American investors and businesses navigate today’s market entry opportunities. The Dutch built Indonesia’s administrative systems (creating predictable business environments), while the French influence in Vietnam, Laos, and Cambodia has established legal frameworks that continue to facilitate international business today.

Market Entry Advantages by Country:

● Philippines: American-style education system, English proficiency, shared democratic

values

● Singapore: Common law system, international arbitration hub, tax incentives

● Malaysia: English-speaking workforce, established manufacturing base, Islamic finance

expertise

● Vietnam: Rapid economic growth, young workforce, government incentives for foreign

investment

● Thailand: Regional headquarters location, automotive industry cluster, tourism

infrastructure

British colonial legacy in Myanmar and Malaysia created English-speaking business cultures and common law systems familiar to American companies. The Philippines offers unique advantages—with both Spanish cultural influences and American-style education and business practices from its period as a U.S. territory, making it perhaps the most accessible Southeast Asia market for American businesses.

Language Benefits for U.S. Companies: This colonial diversity created the region’s incredible

linguistic variety—over 1,000 languages are spoken across Southeast Asia—but it also

established English as the predominant international business language, giving American

companies a natural competitive advantage in Southeast Asia business expansion.

Religious Diversity: Stability Through Pluralism

Unlike Middle Eastern markets, Southeast Asia has mastered religious diversity in ways that

create stable business environments. This isn’t just about tolerance—it’s about economic

opportunity.

Buddhist Nations: Stable, Growth-Oriented Markets

Thailand, Cambodia, Laos, Myanmar, and Vietnam are predominantly Buddhist, creating

societies that value stability, community cooperation, and long-term thinking—ideal

characteristics for sustainable business partnerships. Buddhist emphasis on education and

self-improvement has created skilled workforces that American tech and manufacturing

companies increasingly rely on.

Islamic Markets: The World’s Largest Muslim Economy

Indonesia alone has 230 million Muslims—more than the entire Middle East combined. But

unlike volatile regions, Southeast Asian Islam emphasizes trade, entrepreneurship, and

international cooperation. Malaysia and Brunei offer Sharia-compliant financial services and

halal certification systems that help American companies access global Muslim markets worth

over $2 trillion annually.

Christian Connections: Natural American Allies

The Philippines and Timor-Leste, with Christian majorities, share cultural values and democratic traditions with the United States. The Philippines, in particular, has become America’s call center capital and a key ally in maintaining Pacific security—creating natural business and strategic partnerships. Singapore operates as a secular city-state where all religions coexist peacefully, making it the perfect regional headquarters for American multinational corporations serving diverse markets.

ASEAN Free Trade Agreement: America’s Untapped $600

Billion Market Opportunity

The Association of Southeast Asian Nations (ASEAN) represents one of the world’s most successful free trade agreements—and it’s happening without America (yet). Established in 1967, ASEAN created something the U.S. has struggled to achieve: a nearly seamless economic union that actually works.

Trade Numbers That Should Make Washington Take Notice

ASEAN members have eliminated 99% of internal tariffs, creating a $600 billion internal market. The ASEAN Trade in Goods Agreement makes doing business across borders easier than trading between some U.S. states. Intra-ASEAN trade now accounts for 21.5% of total regional trade, and American companies are missing out on much of this growth.

Here’s the key insight: while America debates trade policy, Southeast Asian nations are building

the supply chains of the future. Vietnamese factories produce components that are assembled

in Malaysia, shipped through Singapore, and financed by Thai banks—all with minimal

bureaucratic friction.

Supply Chain Diversification: America’s China Alternative

For American businesses seeking China alternatives, Southeast Asia offers compelling advantages: competitive manufacturing costs, English-speaking workforces, and pro-business governments. Major U.S. corporations like Apple (iPhone production in Vietnam), Nike (footwear Manufacturing in Indonesia), and Ford (automotive assembly in Thailand) have already established a successful Southeast Asia operation

Southeast Asia vs China Manufacturing Cost Comparison:

| Country | Labor Cost vs China | Infrastructure Quality | Trade Agreement Benefits |

|---|---|---|---|

| Vietnam | 40% lower | Rapidly improving | CPTPP member, EU trade deal |

| Indonesia | 35% lower | Established | ASEAN benefits, large domestic market |

| Philippines | 45% lower | Growing | U.S. trade preferences, English proficiency |

| Thailand | 30% lower | Excellent | Japan partnership, automotive expertise |

| Malaysia | 25% lower | World-class | Islamic finance hub, tech manufacturing |

American Companies Successfully Operating in Southeast Asia:

● Apple: iPhone assembly in Vietnam, AirPods production

● Nike: Footwear manufacturing across Vietnam, Indonesia, Thailand

● Ford: Automotive production in Thailand for regional export

● Intel: Semiconductor assembly and testing in Malaysia, Philippines

● Microsoft: Cloud services and software development in Singapore

The Great Labor Migration: Southeast Asia’s Economic

Engine

Southeast Asia experiences a massive internal migration that surpasses the American economy in terms of labor mobility. Approximately 6.9 million workers move freely across borders, generating $25 billion in annual remittances. Indonesian construction workers build Malaysian skyscrapers, Philippine nurses staff Singaporean hospitals, and Myanmar farmers harvest Thai crops.

This labor flexibility creates economic resilience and keeps inflation low—lessons American

policymakers could learn from. Unlike America’s immigration debates, Southeast Asian nations

have created systems that benefit both sending and receiving countries.

Country-Specific Investment Guide: Southeast Asia

Market Analysis

High-Income Markets: Singapore and Brunei Investment Opportunities

Singapore Business Environment:

● GDP per capita: $72,000 (exceeds most U.S. states)

● Ease of Doing Business: Ranked #2 globally

● Key sectors: Fintech, biotech, logistics, regional headquarters

● Tax incentives: 17% corporate tax, numerous exemptions

● Strategic advantage: ASEAN hub for American multinational corporations

Singapore’s transformation from a developing nation to a global financial center in just 50 years proves that smart policies and strategic location can create prosperity faster than traditional development models. American financial services, technology, and logistics companies find Singapore to be an ideal regional headquarters location.

Middle-Income Powerhouses: Thailand, Malaysia, Indonesia

Thailand: The Detroit of Southeast Asia

● Automotive industry: Ford, General Motors, Toyota production hubs

● Investment incentives: Board of Investment tax holidays up to 8 years

● Infrastructure: Eastern Economic Corridor development zone

● Market size: 70 million consumers with a rising middle class

Malaysia: Semiconductor and Electronics Hub

● Industry focus: Global semiconductor assembly and testing

● Advantages: English-speaking workforce, established supply chains

● Government support: Malaysia Digital Economy Corporation incentives

● Islamic finance: Gateway to $2 trillion halal market

Indonesia: Southeast Asia’s Largest Consumer Market

● Market potential: 270 million consumers, fastest-growing middle class

● Resource wealth: Palm oil, mining, energy sectors

● Digital economy: E-commerce growing 40% annually

● Investment zones: Special Economic Zones with tax incentives

Emerging Markets: Vietnam, Philippines, Cambodia

Vietnam: The New Manufacturing Powerhouse

● Growth rate: 6-7% annual GDP growth

● Trade agreements: CPTPP, EU-Vietnam FTA benefits

● Manufacturing focus: Electronics, textiles, automotive parts

● Investment incentives: Up to 15-year tax holidays in priority sectors

Philippines: America’s Natural Business Partner

● Language advantage: Largest English-speaking workforce in Asia

● Cultural alignment: American business practices and democratic values

● Service sectors: Business process outsourcing, call centers, IT services

● Economic zones: PEZA incentives for export-oriented businesses

Cambodia: Last Frontier for Ultra-Competitive Manufacturing

● Cost advantage: Lowest labor costs in the region

● Trade access: Everything But Arms EU agreement, GSP benefits

● Growing sectors: Textiles, electronics assembly, and agriculture processing

● Political stability: Consistent pro-business policies

Tourism Gold Mine: America’s Vacation Deficit

Americans spend over $150 billion annually on international travel, but Southeast Asia captures less than 10% of this market. That represents a massive missed opportunity. UNESCO World Heritage sites like Cambodia’s Angkor Wat, Indonesia’s Borobudur, and Vietnam’s Hoi An Ancient Town offer cultural experiences that rival European destinations at a fraction of the cost.

The region’s tourism infrastructure has exploded—five-star resorts, international airports, and

English-speaking service staff is now standard across major destinations. American travelers get

more luxury for less money while supporting economies that buy American products and

services.

Geopolitical Reality Check: Cultural Sites as Strategic

Assets

Southeast Asia’s occasional territorial disputes—like the Cambodia-Thailand conflict over Preah Vihear temple—remind us that even paradise has politics. But these disputes pale compared to Middle Eastern conflicts or European tensions. Most importantly, these nations resolve conflicts through international law and diplomatic negotiation, not military action. For American businesses, this represents a manageable risk in exchange for an enormous opportunity.

Infrastructure Boom: Building Tomorrow’s Economy

Today

Southeast Asia is experiencing an infrastructure revolution that exceeds American investment levels. The ASEAN Master Plan on Connectivity includes projects that would impress American infrastructure advocates:

● High-speed rail networks connecting major cities faster than Amtrak connects Boston

to Washington

● Smart ports and airports that process cargo and passengers more efficiently than most

American facilities

● 5G networks and fiber optic systems that provide faster internet than many American

suburbs

● Regional power grids sharing renewable energy across borders

This isn’t just about convenience—it’s about creating economic efficiency that American

Businesses can leverage this for a competitive advantage.

Green Revolution: Environmental Leadership America

Could Follow

While America argues about climate policy, Southeast Asia is implementing solutions. ASEAN

nations are rapidly adopting renewable energy, building climate-resilient infrastructure, and

creating green technology markets worth hundreds of billions of dollars.

Indonesian geothermal energy, Malaysian solar manufacturing, and Vietnamese wind power

projects offer American companies opportunities to lead in growing markets while supporting

environmental goals that both regions share.

The Digital Economy: Asia’s Silicon Valley

Southeast Asia’s digital transformation is happening faster than America’s. Singapore rivals

Silicon Valley for fintech innovation, Indonesia’s e-commerce market grows 40% annually, and

Vietnam produces video games played by millions of Americans. The region’s 400 million internet users represent the world’s fastest-growing digital market—and

they’re adopting American platforms, purchasing American content, and creating opportunities

for American tech companies willing to adapt to local markets.

Strategic Competition: America’s Indo-Pacific Advantage

As U.S.-China tensions escalate, Southeast Asia offers America’s best strategic alternative.

These nations want American investment, value American technology, and share democratic

values (or at least free-market principles). They offer everything China promised—growth,

opportunity, and partnership—without the strategic rivalry and authoritarian governance.

Investment Opportunities: The Numbers Don’t Lie

American foreign direct investment in Southeast Asia totals over $400 billion, but that’s still less

than U.S. investment in the Netherlands alone. The upside potential is enormous:

● Stock markets in Vietnam, Indonesia, and the Philippines have outperformed the S&P

500 over the past decade

● Real estate markets in major cities offer better returns than most American markets

● Infrastructure bonds provide stable returns while supporting development

● Private equity opportunities in family businesses transitioning to professional

management

Why American Businesses Can’t Afford to Wait

Every month, American companies delay Southeast Asian expansion, and competitors gain

advantages that become harder to overcome. European companies already dominate many

sectors, Chinese firms control critical supply chains, and Japanese businesses have

decades-long relationships.

The window for American leadership remains open, but it’s closing. Companies that establish

Southeast Asian operations now will benefit from first-mover advantages, government

incentives, and partnership opportunities that won’t exist in five years.

Conclusion

As the global economy shifts, Southeast Asia trade opportunities are defining the next wave of American business expansion. The region’s political stability, linguistic compatibility, and free trade zones make it a compelling alternative to traditional manufacturing hubs.

By embracing Southeast Asia trade opportunities now, companies gain early access to government incentives, efficient infrastructure, and new consumer bases. Those who delay risk falling behind competitors who are already building lasting partnerships across ASEAN nations.

If your business is serious about sustainable growth in 2025 and beyond, Southeast Asia trade opportunities are where your next chapter should begin.

FAQ: Southeast Asia Business Guide for Americans

Companies

What are the best Southeast Asia countries for American business investment?

Top 5 Southeast Asia Investment Destinations for U.S. Companies:

- Singapore: Regional headquarters, fintech innovation, ease of doing business

- Vietnam: Manufacturing hub, young workforce, rapid economic growth

- Philippines: English-speaking talent, BPO services, cultural alignment

- Thailand: Automotive industry, established infrastructure, ASEAN hub

- Malaysia: Electronics manufacturing, Islamic finance, government incentives

How does Southeast Asia compare to China for manufacturing?

Southeast Asia vs China Manufacturing Advantages:

● Cost savings: 25-45% lower labor costs across the region

● Trade benefits: ASEAN free trade agreements, reduced tariffs

● Political stability: Less geopolitical tension with the United States

● Language barrier: English proficiency in key markets

● Supply chain: Diversification reduces single-country dependency

What are the ASEAN trade agreement benefits for American companies?

ASEAN Benefits for U.S. Businesses:

● 99% tariff elimination within ASEAN creates seamless market access

● $600 billion internal market with streamlined customs procedures

● Regional supply chain integration opportunities

● Labor mobility facilitates skilled workforce access

● Unified standards reduce compliance costs across multiple markets

Which Southeast Asia countries offer the best tax incentives?

Tax Incentive Comparison:

● Singapore: 17% corporate tax, startup exemptions, R&D incentives

● Malaysia: Pioneer status up to 10 years tax exemption

● Thailand: Board of Investment holidays up to 8 years

● Vietnam: 15-year tax holidays in priority economic zones

● Philippines: PEZA incentives for export-oriented businesses

How can American companies enter Southeast Asia markets?

Market Entry Strategies:

- Joint ventures with local partners for market knowledge

- Regional headquarters in Singapore for ASEAN coverage

- Manufacturing partnerships in Vietnam or Thailand

- Service centers in the Philippines for English-speaking operations

- E-commerce platforms for direct consumer market access

What are the main challenges for American businesses in Southeast Asia?

Common Challenges and Solutions:

● Regulatory complexity: Engage local legal counsel and consultants

● Cultural differences: Invest in cross-cultural training and local partnerships

● Infrastructure gaps: Focus on developed urban centers initially

● Currency fluctuations: Use hedging strategies and local banking relationships

● Talent acquisition: Partner with local universities and training programs

Is Southeast Asia a good alternative to China for supply chains?

Supply Chain Diversification Benefits:

● Risk reduction: Multiple country sourcing reduces geopolitical exposure

● Cost competitiveness: Lower labor and operational costs

● Quality improvement: Established manufacturing expertise in key sectors

● Trade advantages: Better trade relations with the United States

● Growth potential: Rapidly expanding domestic markets for future sales

What sectors offer the best opportunities in Southeast Asia?

High-Growth Sectors for American Investment:

● Technology: Fintech, e-commerce, digital services

● Manufacturing: Electronics, automotive, textiles

● Healthcare: Medical devices, pharmaceuticals, telemedicine

● Infrastructure: Construction, transportation, energy

● Financial services: Banking, insurance, investment management

Answer The Question:

1. Which Southeast Asian country do you think offers the best opportunity for American businesses—and why?

2. Would you trust Southeast Asia as a supply chain alternative to China for your business? Why or why not?

3. Have you ever considered investing in Southeast Asia’s digital economy? What sector would interest you most?

4. Do you believe religious and cultural diversity makes Southeast Asia a more stable business environment?

5. What’s stopping American companies from moving faster into Southeast Asia’s $3.7 trillion market?