India-US Trade Relations: Sanctions, Tariffs, and Strategic Implications

The diplomatic and economic relationship between India and the United States has experienced significant fluctuations over the decades, characterized by periods of strategic cooperation and sharp confrontations. The India-US trade war 2025 represents a critical escalation in this bilateral relationship, with renewed challenges that threaten to impact global trade dynamics and economic stability across international markets.

Historical Context: The 1998 Nuclear Tests and Economic Sanctions

In May 1998, India conducted a series of nuclear tests at Pokhran, marking a pivotal moment in its strategic capabilities. The United States responded decisively under the Glenn Amendment, implementing comprehensive economic sanctions that included:

- Suspension of all military and economic assistance

- Freezing of loans from American financial institutions

- Blocking access to US aerospace and uranium technology

- Restricting India’s access to international lending institutions, except for humanitarian food purchases

The geopolitical implications were severe, particularly as Pakistan conducted its own nuclear tests in response, raising concerns about a regional arms race. However, India demonstrated remarkable economic resilience during this period. The country’s growing economy and limited trade dependence on the United States mitigated the immediate impact. Most international partners, with the notable exception of Japan, did not impose similar sanctions. Within a year, the majority of sanctions were lifted, paving the way for renewed cooperation.

The 2025 Trade Crisis: Current Challenges

Two decades later, Indo-US trade has evolved into a cornerstone of bilateral relations, making the India-US trade war 2025 particularly significant. In July 2025, the United States announced a comprehensive 25% tariff on Indian goods, effective August 1, 2025. This measure affects multiple sectors, including:

- Electronics and technology products

- Pharmaceuticals and healthcare equipment

- Textiles and apparel

- Jewelry and precious goods

- Petrochemicals and related products

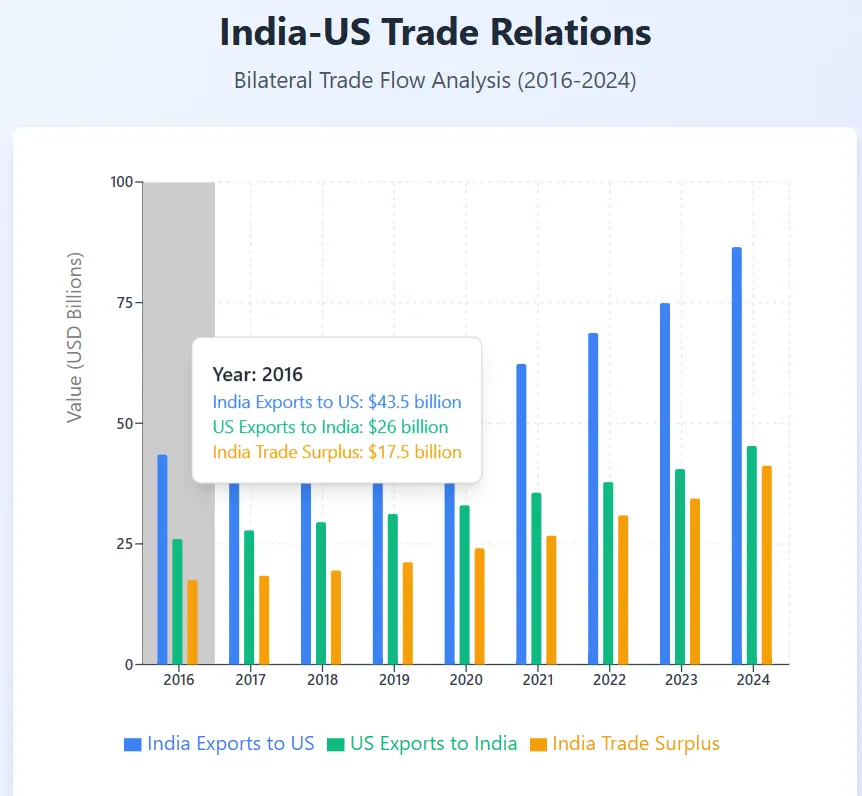

The tariff implementation coincides with secondary sanctions targeting India’s continued energy partnerships and defense cooperation with Russia. The United States justified these measures by citing India’s substantial tariff barriers, the $41 billion bilateral trade surplus in India’s favor, and New Delhi’s reluctance to reduce its strategic partnerships with Russia.

India’s exports to the United States totaled $86.5 billion in fiscal year 2025, with the significant trade surplus representing a substantial portion of India’s export earnings. The India US trade war 2025 has fundamentally altered the dynamics of this crucial economic relationship.

Geopolitical Context and Strategic Implications

The current trade tensions reflect broader geopolitical realignments occurring globally. The United States is pursuing a policy of economic decoupling from China while simultaneously pressuring countries maintaining close ties with Russia. India finds itself navigating these pressures while defending its principle of strategic autonomy and multi-alignment foreign policy.

This situation unfolds against the backdrop of ongoing conflicts in Ukraine and the Middle East, volatile global energy markets, and rising inflation worldwide. The economic confrontation between the world’s fifth-largest economy and one of its primary export destinations has implications extending far beyond bilateral relations. The India US trade war 2025 serves as a catalyst for broader shifts in global trade architecture.

Economic Impact Assessment

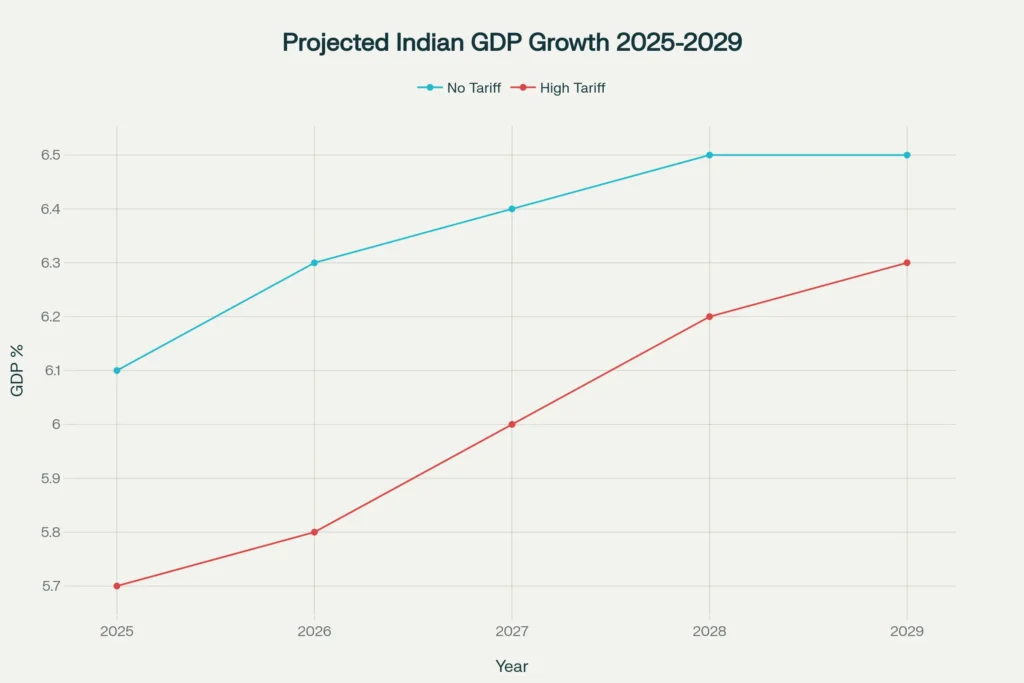

Growth Projections

Economic analysts project that the tariff measures could reduce India’s GDP growth by 20 to 50 basis points (0.2% to 0.5%) in fiscal year 2026. This reduction would particularly affect sectors with significant exposure to US markets, including textiles, electronics, automotive components, jewelry, and processed goods. The India-US trade war 2025 impact extends beyond immediate sectoral effects to broader macroeconomic consequences.

Employment Implications

Labor-intensive industries face the most severe challenges, with small and medium enterprises particularly vulnerable. Without targeted government intervention, these sectors may experience substantial job losses, potentially leading to social and economic distress. The India-US trade war 2025 threatens employment across multiple manufacturing sectors.

Trade Relations

The tariff implementation has effectively stalled progress on bilateral trade negotiations that appeared promising. A complete breakdown in trade talks could undermine investor confidence and damage long-term economic cooperation prospects. The India-US trade war of 2025 has created uncertainty about future bilateral economic partnerships.

Financial Market Effects

The Indian rupee faces additional pressure from these measures. Secondary sanctions targeting India’s Russian oil imports could further destabilize energy markets, potentially increasing domestic prices and creating financial market volatility. Currency markets are closely monitoring developments in the India-US trade war 2025.

Sanctions Framework and Compliance Challenges

Beyond tariffs, the United States has imposed sanctions on several Indian companies throughout 2024 and 2025 for conducting business with Iran and Russia, particularly in oil and defense sectors. The Countering America’s Adversaries Through Sanctions Act (CAATSA) remains a persistent concern, though India has thus far avoided formal penalties. However, each defense transaction with Russia intensifies debate within US policy circles. The broader context of the India-US trade war 2025 includes these multilayered sanctions regimes.

Strategic Response Options for India

Diplomatic Engagement

Maintaining open dialogue channels remains essential. India should pursue negotiated solutions, including sectoral exemptions or phased tariff reductions, while protecting core national interests and strategic autonomy principles. Diplomatic efforts could help de-escalate the India US trade war 2025.

Market Diversification

Accelerating free trade agreement negotiations with the United Kingdom, European Union, ASEAN nations, and African countries represents a critical priority. Diversifying export markets reduces dependence on any single trading partner and enhances economic resilience. Market diversification strategies become more urgent amid the India US trade war 2025.

Domestic Industry Support

The government must implement targeted support measures for affected sectors, including export incentives, credit facilities, and workforce development programs. Small and medium enterprises require particular attention given their vulnerability to market disruptions stemming from the India US trade war 2025.

Regional Economic Integration

Strengthening ties within BRICS and exploring alternative payment mechanisms, such as local currency settlements, can reduce dependence on dollar-denominated transactions and Western financial systems. Regional partnerships offer alternatives during the India US trade war 2025.

Strategic Independence

Diversifying energy partnerships and reducing reliance on US technology and capital markets aligns with strategic autonomy objectives while enhancing economic security. The India US trade war 2025 underscores the importance of reducing strategic dependencies.

Policy Approaches to Avoid

Retaliatory Measures

Implementing reciprocal tariffs might provide short-term political satisfaction but could ultimately harm India’s economy more than the United States. Small businesses and consumers would bear the primary burden of such measures. Escalating the India US trade war 2025 through retaliation risks greater economic damage.

Compromising Core Interests

Making concessions on food security, agricultural policies, or environmental standards to appease US demands could trigger domestic opposition and undermine long-term national priorities.

Neglecting Social Impact

Failing to address the social consequences of job losses and economic disruption could create domestic instability. Comprehensive support programs represent both sound policy and moral obligation.

Energy Security Compromises

Reducing Russian energy partnerships without securing reliable alternatives could expose India to volatile global markets. Any transitions must be strategic and voluntary rather than coerced.

Regional and Global Implications

The Indo-US trade tensions create significant ripple effects across regional and international economic systems, with ASEAN and BRICS nations experiencing both challenges and opportunities. The India US trade war 2025 influences regional economic dynamics across multiple continents.

ASEAN Economic Impact

The Association of Southeast Asian Nations faces multifaceted consequences from the deteriorating Indo-US trade relationship:

Trade Diversion Effects

Several ASEAN economies stand to benefit from trade diversion as US importers seek alternatives to Indian suppliers. Vietnam, Thailand, and Malaysia are particularly well-positioned to capture market share in sectors such as:

- Textile and garment manufacturing, where Vietnam’s established supply chains can absorb redirected orders

- Electronics assembly and components, with Thailand and Malaysia offering competitive alternatives

- Pharmaceutical intermediates and generic drugs, where several ASEAN nations have developed capabilities

Supply Chain Disruptions

However, the integrated nature of Asian supply chains means significant disruptions for ASEAN nations:

- Raw Material Dependencies: Many ASEAN manufacturers rely on Indian chemical intermediates, steel, and agricultural products. Tariff-induced price increases affect their cost competitiveness

- Financial Services: Indian IT and financial services providers serve numerous ASEAN companies. Service disruptions or increased costs could impact regional business operations

- Energy Markets: India’s reduced access to US energy technology may increase competition for alternative suppliers, potentially raising energy costs across Asia

Investment Climate Uncertainty

The trade conflict creates broader uncertainty affecting ASEAN’s investment attractiveness:

- Foreign direct investment flows may become more cautious as investors reassess regional stability

- Infrastructure projects involving Indian companies may face financing challenges

- Long-term supply chain planning becomes more complex, potentially delaying expansion decisions

Currency and Financial Market Effects

ASEAN currencies face mixed pressures:

- Countries benefiting from trade diversion may see currency appreciation

- Regional currencies may experience volatility due to uncertainty about US trade policy consistency

- Bond markets may reflect increased risk premiums for emerging Asian economies

BRICS Economic Realignment

The Brazil, Russia, India, China, and South Africa bloc faces both challenges and accelerated integration opportunities amid the India US trade war 2025:

Intra-BRICS Trade Intensification

Facing Western economic pressure, BRICS nations are rapidly deepening economic ties:

- Bilateral Trade Agreements: India and China, despite border tensions, may expand trade in non-sensitive sectors to reduce Western dependence

- Energy Cooperation: Russia’s energy exports to India, Brazil, and China are expanding, with new long-term contracts being negotiated at preferential rates

- Technology Transfer: China and India are exploring greater cooperation in telecommunications, renewable energy, and pharmaceutical sectors

- Agricultural Trade: Brazil and Russia are increasing food exports to India and China, reducing reliance on Western agricultural markets

Alternative Financial Architecture Development

BRICS is accelerating the development of dollar-independent financial systems:

New Development Bank Expansion

- Increased lending capacity to support infrastructure projects across member nations

- Development of local currency lending mechanisms to reduce dollar exposure

- Expansion of project financing for renewable energy and digital infrastructure initiatives

Payment System Integration

- Acceleration of BRICS Pay development, enabling direct currency exchanges between member nations

- Integration of national payment systems (India’s UPI, China’s DCEP, Russia’s SPFS)

- Development of trade finance mechanisms bypassing SWIFT and Western banking systems

Currency Cooperation Mechanisms

- Increased use of Chinese yuan and Indian rupee in bilateral trade settlements

- Development of currency swap agreements to support trade during volatile periods

- Exploration of a common BRICS currency for specific trade transactions

Industrial Policy Coordination

BRICS nations are coordinating industrial development strategies:

- Critical Materials: Securing supply chains for rare earth elements, lithium, and other strategic materials

- Manufacturing Relocation: Chinese manufacturers are establishing operations in India and Brazil to serve local markets and avoid Western tariffs

- Technology Standards: Development of alternative technical standards for telecommunications, digital payments, and industrial equipment

Challenges and Limitations

Despite increased cooperation, BRICS faces significant constraints:

Economic Disparities

- Vast differences in development levels create unequal benefits from integration initiatives

- Currency volatility in some member nations complicates long-term planning

- Limited financial market development in some countries restricts capital flows

Geopolitical Tensions

- India-China border disputes continue to limit full economic integration

- Russia’s international isolation affects its ability to contribute to certain sectors

- Brazil’s changing political alignment creates uncertainty about long-term commitment

Infrastructure Limitations

- Transportation links between BRICS nations remain underdeveloped

- Digital infrastructure integration requires substantial investment

- Regulatory harmonization across diverse legal systems proves challenging

Market Access Restrictions

- Domestic industries in each country may resist increased competition from BRICS partners

- Technical barriers and standards differences complicate trade expansion

- Services sector integration remains limited compared to goods trade

Broader Implications for Global Trade Architecture

The ASEAN and BRICS responses to Indo-US trade tensions contribute to a broader fragmentation of the global trading system:

Regional Bloc Strengthening

- Acceleration of regional comprehensive economic partnerships

- Development of alternative dispute resolution mechanisms

- Creation of parallel institutions to traditional Western-dominated organizations

Technology and Standards Divergence

- Development of competing technical standards and certification systems

- Fragmentation of digital payment and communication networks

- Reduced interoperability between regional trading blocs

Financial System Bifurcation

- Emergence of parallel international financial architectures

- Reduced effectiveness of traditional economic sanctions

- Increased complexity in international monetary policy coordination

This realignment represents a fundamental shift toward a multipolar economic order, with ASEAN and BRICS playing increasingly important roles in global trade and financial systems. The India US trade war 2025 serves as a catalyst for these broader transformations in international economic architecture.

Frequently Asked Questions

1. Why did the United States impose 25% tariffs on Indian goods in July 2025?

The United States cited three primary reasons for implementing the comprehensive tariff measures: India’s “very high” tariff barriers on American goods, the substantial $41 billion trade surplus in India’s favor (out of total Indian exports of $86.5 billion to the US in FY25), and India’s continued strategic partnerships with Russia, particularly in defense procurement and energy imports. The US viewed these factors as undermining fair trade practices and conflicting with American foreign policy objectives regarding Russia sanctions. The tariffs represent both an economic response to trade imbalances and a geopolitical tool to pressure India to align more closely with US strategic interests.

2. How significant is the economic impact of these tariffs on India’s GDP?

Economic analysts project that the 25% tariffs could reduce India’s GDP growth by 20 to 50 basis points (0.2% to 0.5%) in fiscal year 2026. While this may appear modest in percentage terms, the impact represents billions of dollars in lost economic output for the world’s fifth-largest economy. The effects will be most pronounced in export-dependent sectors such as textiles, electronics, pharmaceuticals, jewelry, and petrochemicals. Labor-intensive industries face particular challenges, with potential job losses in small and medium enterprises that lack the resources to quickly pivot to alternative markets. The broader economic impact extends to currency pressure on the rupee, potential inflation from disrupted supply chains, and reduced investor confidence affecting long-term growth prospects.

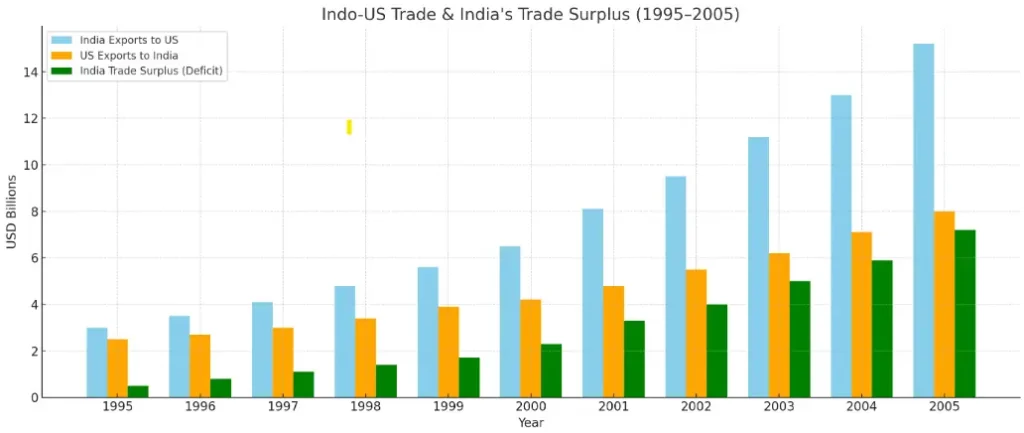

3. What happened during India’s previous experience with US sanctions in 1998, and how does it compare to the current situation?

Following India’s nuclear tests in May 1998, the United States imposed comprehensive sanctions under the Glenn Amendment, including suspension of military and economic aid, freezing American bank loans, and blocking access to advanced technology. However, India’s economy was less integrated with global markets at that time, and bilateral trade was limited, reducing the immediate impact. Most other countries did not impose similar sanctions, and the measures were lifted within a year as geopolitical dynamics shifted. The current situation is fundamentally different: India-US trade has grown exponentially (from minimal levels in 1998 to $86.5 billion in Indian exports by 2024), making the economic stakes much higher. Additionally, the 2025 measures are primarily trade-focused rather than comprehensive sanctions, but they affect a much larger and more integrated economic relationship.

4. How are BRICS countries responding to increased Western economic pressure, and what alternatives are they developing?

BRICS nations are accelerating the development of alternative economic architectures to reduce dependence on Western-dominated systems. Key initiatives include expanding the New Development Bank’s lending capacity for infrastructure projects, developing BRICS Pay as an alternative to SWIFT-based payment systems, and increasing bilateral trade settlements in local currencies rather than US dollars. The bloc is also pursuing greater industrial coordination, with China establishing manufacturing operations in India and Brazil to serve local markets while avoiding Western tariffs. Russia is expanding energy exports to other BRICS members at preferential rates, creating new supply chain relationships independent of Western markets. However, these efforts face significant challenges including economic disparities between member nations, ongoing geopolitical tensions (particularly between India and China), and infrastructure limitations that complicate deeper integration.

5. What strategic options does India have to mitigate the impact of US tariffs without compromising its foreign policy principles?

India has several strategic options that balance economic interests with its commitment to strategic autonomy. Market diversification represents the most immediate opportunity, including accelerating free trade agreement negotiations with the UK, EU, ASEAN, and African nations to reduce dependence on the US market. Domestically, the government can implement targeted support for affected industries through export incentives, credit facilities, and workforce retraining programs. Strengthening regional partnerships within BRICS and exploring alternative payment mechanisms can reduce exposure to dollar-based transactions. India can also leverage its position as a critical supplier in global value chains, particularly in pharmaceuticals and information technology services, to negotiate sector-specific exemptions. The key is pursuing these options while maintaining dialogue with the United States to prevent further escalation, demonstrating that India can be a reliable partner without sacrificing its core strategic interests or sovereignty in foreign policy decisions.

Discussion Questions for Analysis

1. Strategic Trade Policy Assessment

Given the substantial growth in India’s trade surplus with the United States (from $17.5 billion in 2016 to $41.2 billion in 2024), was the US response predictable and justified from an economic perspective? How should countries balance bilateral trade relationships when significant imbalances emerge, and what alternative approaches could both nations have pursued to address these concerns before resorting to tariff measures?

2. Geopolitical Alignment vs. Economic Interdependence

India’s principle of strategic autonomy allows it to maintain relationships with multiple global powers, including Russia, despite Western sanctions. In an increasingly polarized world, is it realistic for major economies to remain truly non-aligned? Evaluate whether India’s approach strengthens its negotiating position or creates unnecessary economic vulnerabilities, and consider what this means for other middle powers facing similar pressures.

3. Regional Economic Architecture Evolution

The Indo-US trade conflict is accelerating the development of alternative economic systems through BRICS and regional partnerships. Do these emerging financial and trade mechanisms represent a fundamental challenge to the Western-led global economic order, or are they complementary systems that will eventually integrate? What are the long-term implications for global economic stability and efficiency?

4. Supply Chain Resilience and Diversification

The current crisis highlights the risks of over-dependence on single markets or suppliers. From a business strategy perspective, how should companies and countries balance the efficiency gains from specialization and concentrated partnerships against the security benefits of diversification? What lessons can be drawn for supply chain management in an era of increasing geopolitical volatility?

5. Democratic Values and Economic Pragmatism

Both India and the United States are democratic nations with shared values, yet they find themselves in economic confrontation due to different strategic priorities. How should democratic countries navigate situations where their economic interests and geopolitical alignments diverge? Is it possible to maintain strong democratic partnerships while pursuing independent foreign policies, and what role should values play in international trade relationships?

Conclusion and Strategic Outlook

The current sanctions and tariffs represent diplomatic tools with significant economic costs. India’s response to these challenges will determine its economic trajectory for years ahead. The nation must balance resilience, diplomatic engagement, and strategic foresight to navigate this complex environment successfully.

India’s foreign policy has historically emphasized non-alignment, strategic autonomy, and economic pragmatism. Under growing US pressure, the country must maintain global partnerships while safeguarding national interests. The government’s ability to manage these competing demands while protecting domestic economic interests will be crucial.

Ultimately, while sanctions and tariffs may be temporary measures, India’s strategic response will have lasting implications for its position in the global economy and international trade relationships. Success requires careful navigation between cooperation and independence, ensuring that short-term pressures do not compromise long-term strategic objectives.

Other Reading:

Timeline: U.S.-India Relations

U.S. sanctions on Russia and its impact on India – Gateway House