Introduction

In 2025, Brazil’s economy is handling tariff terror with unprecedented sophistication as the nation faces a dramatic economic showdown with the United States. This comprehensive analysis examines how Brazil’s economy is handling tariff terror through strategic responses to America’s aggressive 50% tariff impositions, revealing a masterclass in economic resilience that’s reshaping global trade dynamics and offering valuable lessons for emerging economies worldwide.

Setting the Economic Foundation: Understanding Brazil’s Strength

Before examining how Brazil’s economy is handling tariff terror, we must understand the robust foundation that enables this resilience. Brazil enters 2025 as Latin America’s undisputed economic powerhouse and the world’s eighth-largest economy by purchasing power parity. With a projected GDP (PPP) of $4.89 trillion and growth forecasts between 2.2% and 2.3%, Brazil demonstrated remarkable early momentum with Q1 growth of 1.4%—outperforming the United States, European Union, and G7 nations.

This economic strength rests on three pillars. First, Brazil’s industrial sector contributes approximately 22% to GDP, making it the second-largest manufacturing base in Latin America after Mexico. Second, its agricultural dominance spans global leadership in soybeans, corn, beef, sugarcane, and coffee production. Third, Brazil’s strategic trade positioning places it 8th globally in exports with annual sales reaching $77.31 billion in 2025—a remarkable doubling from the previous year.

| Brazil’s Economic Foundation (2025) | Key Metrics |

|---|---|

| GDP (PPP) | $4.89 trillion |

| Global GDP Ranking | 8th largest by purchasing power |

| Regional Position | Latin America’s largest economy |

| GDP Growth Forecast | 2.2% – 2.3% |

| Q1 2025 Growth | 1.4% (outpaced US, EU, G7) |

| Industrial Sector | 22% of GDP |

| Manufacturing Rank (Latin America) | 2nd largest (after Mexico) |

The Anatomy of Brazil’s Trade Architecture

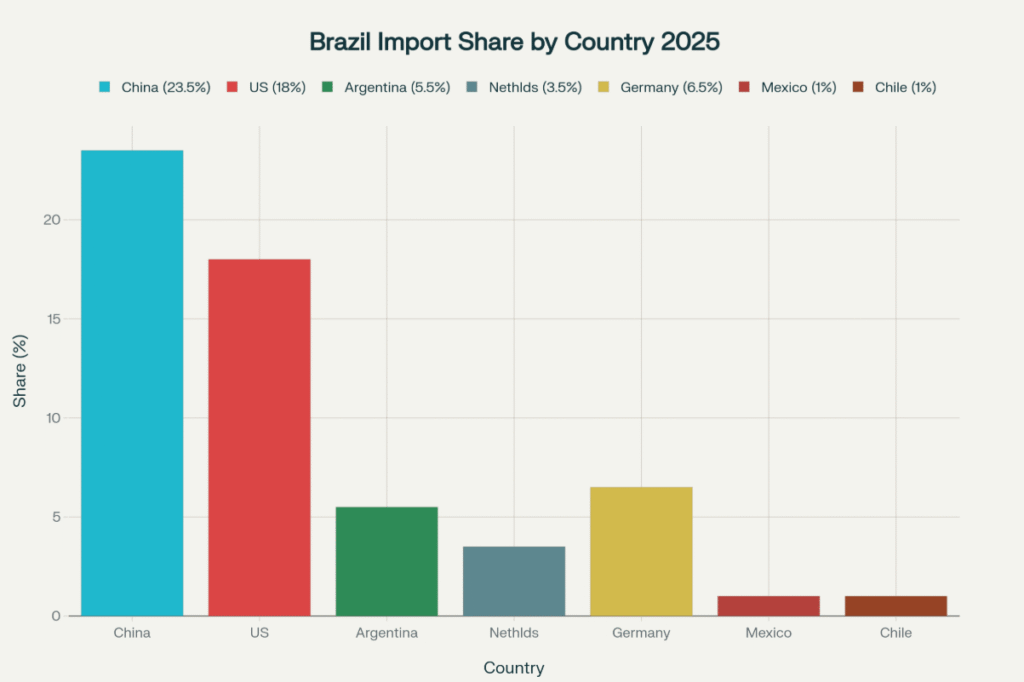

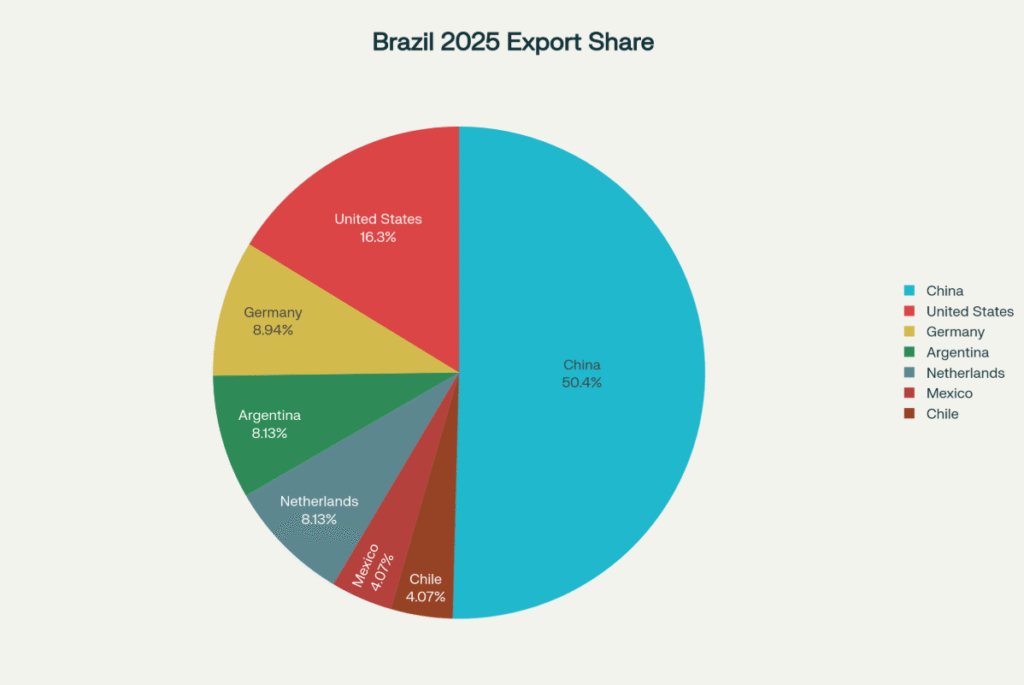

To understand how Brazil’s economy is handling tariff terror, we must first examine its trade structure. Brazil’s export destinations reveal a carefully diversified portfolio: China dominates with 31% of exports, followed by the United States at 10%, then Argentina, Netherlands, Spain, Canada, Singapore, Chile, Germany, and Mexico.

This diversification proves prescient when we consider import patterns. Brazil’s $70.90 billion in imports (also doubled from 2024, ranking 9th globally) shows similar geographic spread: China supplies 22-25% of imports, while the United States contributes 17-19%. Brazil has a surprisingly trade surplus with China.

Notice the strategic balance here—while China leads both export destinations and import sources, no single partner dominates completely. This diversification becomes crucial in understanding Brazil’s resilience against unilateral trade actions.

| Brazil’s Trade Profile (2025) | Exports | Imports |

|---|---|---|

| Total Value | $77.31 billion | $70.90 billion |

| Global Ranking | 8th | 9th |

| Year-over-Year Growth | Doubled from 2024 | Doubled from 2024 |

| Trade Balance | -$324 million deficit (early 2025) |

| Top Trading Partners | Export Share | Import Share |

|---|---|---|

| China | 31% | 22-25% |

| United States | 10% | 17-19% |

| Argentina | Major partner | – |

| Netherlands | Major partner | – |

| Germany | Major partner | – |

| Key Export Products | Key Import Products |

|---|---|

| Soybeans, Iron Ore, Oil, Beef (to China) | Electronics, Machinery, Chemicals (from China) |

| Oil, Aircraft, Machinery (to US) | Machinery, Aircraft, Chemicals (from US) |

The Tariff Terror: Anatomy of Economic Warfare

On July 9, 2025, the economic landscape shifted dramatically. President Donald Trump announced sweeping 50% tariffs on Brazilian exports, effective August 1—one of the most aggressive single-country tariff actions in modern trade history. These measures targeted steel, aluminum, machinery, wood products, automotive parts, and agricultural goods.

But here’s the critical insight: this wasn’t purely economic policy. The tariffs explicitly linked to Brazil’s prosecution of former President Jair Bolsonaro for his alleged role in a 2022 coup attempt. Trump characterized this as a “witch-hunt,” transforming trade policy into a tool of political intervention.

The mathematical impact is stark. Brazil’s effective average US tariff rate jumped from 11.7% to 32.7%. Economic modeling suggests this could reduce Brazil’s GDP by 0.4-0.6% in 2025, with potential losses of 0.6-1.0% if tariffs persist over multiple years.

| US Tariff Impact on Brazil | Before July 2025 | After July 2025 |

|---|---|---|

| Effective Average Tariff Rate | 11.7% | 32.7% |

| Tariff Increase | – | 50% on targeted goods |

| Effective Date | – | August 1, 2025 |

| Targeted Sectors | Exempted Products |

|---|---|

| Steel & Aluminum | Aircraft |

| Machinery | Orange Juice |

| Wood Products | Crude Oil |

| Auto Parts | |

| Agricultural Goods | |

| Coffee & Meat |

| Projected Economic Impact | 2025 | Multi-year |

|---|---|---|

| GDP Reduction | 0.4-0.6% | 0.6-1.0% |

| Most Affected Sectors | Steel, aluminum, machinery, autos, coffee, meat |

Brazil’s Masterclass Response: The Five-Pillar Strategy

How is Brazil’s economy handling tariff terror? Through what we can call the “Brazilian Model”—a sophisticated five-pillar response strategy that other nations are now studying:

Pillar One: Legal Warfare

On August 6, 2025, Brazil formally challenged the US at the World Trade Organization, arguing violations of the most-favored-nation principle. This isn’t merely procedural—it’s strategic positioning for eventual settlement negotiations.

Pillar Two: Reciprocity Mechanisms

Brazil activated domestic laws enabling suspension of equal treatment for US goods. Notice the restraint here—they prepared the weapon but haven’t fired it, maintaining negotiation space.

Pillar Three: Industrial Protection

Emergency loans, tax breaks, and public procurement programs target sectors facing the heaviest tariff burden—steel, aluminum, machinery, automotive, coffee, and meat industries.

Pillar Four: Strategic Diversification

President Lula intensified relationships with China, Russia, and BRICS nations while expanding into African and Southeast Asian markets. This isn’t reactive—it’s accelerating existing diversification strategies.

Pillar Five: Selective Non-Escalation

Perhaps most importantly, Brazil avoided immediate counter-tariffs, choosing measured responses over emotional reactions.

| Brazil’s Five-Pillar Response Strategy | Action Taken | Timeline |

|---|---|---|

| Legal Warfare | WTO challenge filed | August 6, 2025 |

| Reciprocity Mechanisms | Activated suspension laws (unused) | Ready for deployment |

| Industrial Protection | Emergency loans, tax breaks, public procurement | Ongoing |

| Strategic Diversification | Deepened China, Russia, BRICS, Africa, SE Asia ties | Accelerated program |

| Selective Non-Escalation | Avoided immediate counter-tariffs | Maintained negotiation space |

| Brazilian Model Components | Strategic Purpose |

|---|---|

| Legal Institutionalism | Non-escalatory response mechanism |

| Strategic Patience | Avoid emotional retaliation |

| Economic Cushioning | Protect domestic industries |

| Diversification Acceleration | Reduce US dependency |

| Diplomatic Multilateralism | Strengthen alternative partnerships |

The Science Behind Brazil’s Economy Handling Tariff Terror

Understanding why Brazil’s economy is handling tariff terror more effectively than many predicted requires examining the economic fundamentals that provide this resilience:

Agricultural Innovation: Brazil’s 2025 harvest of 322 million tons represents a 10.2% increase from 2024, driven by AI and biotechnology adoption. Soy and corn yields jumped over 25%, demonstrating technological resilience.

| Brazil’s Agricultural Performance (2025) | Metrics |

|---|---|

| Total Harvest | 322 million tons |

| Year-over-Year Growth | 10.2% increase from 2024 |

| Soy & Corn Yield Improvement | 25%+ increase |

| Technology Drivers | AI and biotechnology adoption |

| Global Leadership | Soybeans, corn, beef, sugarcane, coffee |

| Economic Resilience Factors | Details |

|---|---|

| Market Diversification | China (31% exports), reducing US dependency |

| Commodity Strength | Global leadership in agricultural products |

| Financial Discipline | Central Bank rates at ~15% |

| Geographic Spread | 10+ major trading partners |

Market Flexibility: With China absorbing 31% of exports, Brazil possesses alternative markets when US access becomes restricted. This geographic diversification acts as a natural hedge against unilateral trade actions.

Commodity Strength: Brazil’s position as a global commodity leader—particularly in agricultural products and raw materials—provides pricing power even under tariff pressure.

Financial Positioning: The Central Bank’s maintenance of interest rates near 15% demonstrates monetary policy discipline, creating space for economic maneuvering despite external pressures.

Global Implications: The Brazilian Model

Brazil’s response offers lessons extending far beyond South America. The “Brazilian Model” demonstrates how middle powers can resist economic coercion through:

- Legal institutionalism (WTO challenges)

- Strategic patience (avoiding escalatory responses)

- Economic cushioning (domestic industry support)

- Diversification acceleration (reducing dependency)

- Diplomatic multilateralism (strengthening alternative partnerships)

Looking Forward: Transformation Through Crisis

How will Brazil’s economy continue handling tariff terror? The evidence suggests transformation through adversity. Brazil is leveraging this crisis to accelerate its evolution into a green energy leader, agricultural technology powerhouse, and digital economy innovator.

The tariff terror, intended to weaken Brazil, may paradoxically strengthen its long-term economic positioning by forcing diversification, innovation, and institutional strengthening.

Conclusion: Brazil’s Economy Handling Tariff Terror as a Global Model

This analysis of Brazil’s economy handling tariff terror demonstrates that economic strength lies not in confrontation, but in sophisticated economic statecraft. Brazil’s economy is handling tariff terror through a combination of legal challenges, strategic restraint, domestic protection, and accelerated diversification, offering a masterclass in economic resilience for the modern era.

The ultimate lesson from observing Brazil’s economy handling tariff terror? In an era where trade becomes weaponized, sustainable economic strength comes from strategic adaptation, institutional resilience, and the patient cultivation of alternatives rather than reactive escalation.

This concludes our analysis of Brazil’s economy handling tariff terror. Next week, we’ll examine how this model applies to other emerging economies facing similar pressures in our increasingly fragmented global trading system.

Key Takeaways for Economic Policy:

- Diversification provides natural hedging against trade warfare

- Legal institutions offer non-escalatory response mechanisms

- Strategic patience often proves more effective than immediate retaliation

- Crisis can accelerate beneficial economic transformation

- Middle powers can resist economic coercion through sophisticated statecraft